Financial Influencers: What, Why & How (+ List Of Top Finfluencers)

Curious about financial influencers? Explore what they are, why they’re important, and find our curated list of the top finfluencers to boost your financial savvy!

Ever thought about diving into financial content? It might seem a bit serious, but trust me, it's a goldmine for building your authority, connecting with your audience on a deeper level, and yes, even boosting your earnings! If you're passionate about helping people get smarter with their money, or if you've got your own financial journey to share, this space is calling your name.

We see you – you’re creative, you’re influential, and you're looking for ways to make a real impact. Financial topics are on everyone's mind, especially now. People are hungry for clear, relatable advice, and you could be the one to give it to them. This isn't about becoming a stuffy financial advisor overnight. It's about sharing knowledge, sparking conversations, and empowering your followers.

This guide is your friendly nudge (and a detailed map!) to navigate the exciting path of financial content creation. We’ll break down what it means to be a financial influencer, why it's a fantastic niche, and how you can create content that truly resonates and makes a difference. Plus, we'll even show you how platforms like ryme.ai can supercharge your journey. Let's get you started on money making talk... in a good way! 💰🗣️

What Are Financial Influencers?

Alright, let's break it down. What exactly is a "financial influencer" or "finfluencer" as they're often called? Simply put, you're a financial influencer if you create content about money – anything from saving your first ₹1000 to understanding the stock market – and share it with an online audience. You use your platform to educate, inform, and inspire people to make better financial decisions. You're like that money-savvy friend everyone turns to for advice, but with a bigger audience!

Think about it: traditional financial advice often felt complicated, inaccessible, or even a bit intimidating. Financial influencers are changing that. You make finance approachable, understandable, and even fun. You speak the language of your audience, meet them where they are (scrolling through Insta, watching YouTube), and offer practical insights they can actually use in their daily lives.

According to a 2023 report by a leading influencer marketing hub, the demand for financial literacy content on social media has surged by over 65% in the last two years alone, particularly among Gen Z and Millennials. This shows just how much people are looking for guidance they can trust and relate to.

Scope of Content: What Can You Talk About?

The great thing about financial content is its sheer breadth. You don't have to be a Wall Street guru to get started. Your unique perspective and journey are valuable! Here are some popular areas you can focus on:

Personal Finance Management: This is a huge one! You can cover topics like:

- Creating a realistic budget that doesn't feel like a punishment. (Maybe a "My Fun Budget" template?)

- Tracking expenses effectively (apps, spreadsheets, or even a good old notebook method).

- Managing debt – from credit card bills to student loans. Sharing your own debt-payoff story can be incredibly powerful. For instance, "How Priya paid off her ₹50,000 credit card debt in 6 months!"

- Setting and achieving financial goals, like saving for a down payment on a house, a new car, or that dream vacation.

- Understanding and improving credit scores. An Instagram carousel explaining "5 Ways to Boost Your CIBIL Score" could be a hit!

Investment Strategies (Stocks, Mutual Funds, Crypto): This area attracts a lot of attention, but it's crucial to be responsible.

- Explaining basic investment concepts: What are stocks? What are mutual funds? How does compounding work? Think short, animated videos.

- Demystifying the stock market: How to start investing with small amounts (e.g., "Investing your first ₹1000 in the stock market!").

- Discussing different investment options like SIPs (Systematic Investment Plans), ETFs (Exchange Traded Funds), or even gold.

- Breaking down cryptocurrency basics (if this is your area of expertise): What is blockchain? Different types of crypto? The risks involved. Always emphasize due diligence. A recent survey by crypto platforms in India showed that 72% of new crypto investors in 2023 got their initial information from social media influencers. This highlights the impact you can have, and the responsibility that comes with it.

Important Note: Always remind your audience that you're sharing information, not giving personalized financial advice. Encourage them to do their own research (DYOR).

Budgeting and Saving Tips: Everyone wants to save more money!

- Practical tips for cutting daily expenses without sacrificing quality of life. (e.g., "My top 5 hacks for saving ₹5000 a month on groceries! 🛒")

- Themed savings challenges (e.g., a "52-week savings challenge" reel).

- Reviews of budgeting apps and tools.

- Tips for saving for specific goals: travel, gadgets, education.

Financial Literacy Education: This is the foundation of it all.

- Explaining financial jargon in simple terms. (e.g., "What is Inflation? 🤔 Let's break it down like you're 5!")

- Teaching about banking products: savings accounts, fixed deposits, loans.

- Understanding taxes (basics, of course, not super complex tax law!).

- The importance of emergency funds. A story about how an emergency fund saved someone from a tough spot can be very impactful.

- Raising awareness about financial scams and how to avoid them. This is super important!

Platforms of Influence: Where Can You Shine? ✨

You've got the knowledge, now where do you share it? Different platforms cater to different styles and content formats:

Instagram: Perfect for visual learners.

- Reels: Short, engaging videos explaining complex topics quickly (e.g., a 60-second reel on "Understanding Compound Interest"). Think quick cuts, on-screen text, and trending audio.

- Carousels: Break down information into digestible slides (e.g., "10 Steps to Create Your First Budget").

- Stories: Use polls, Q&As, and quizzes to interact with your audience directly. "Ask Me Anything about Mutual Funds!"

- Lives: Host live sessions with experts or discuss current financial news.

- Example: An influencer could post a Reel showing "3 Money-Saving Apps I Swear By," with quick screen recordings of each app in action.

YouTube: Ideal for more in-depth content.

- Detailed tutorials (e.g., "Step-by-Step Guide to Investing in Index Funds for Beginners").

- Interviews with financial experts.

- Personal finance vlogs sharing your own journey and experiences.

- Product reviews (e.g., "Best Demat Accounts in India for 2025").

- Case studies or deep dives into specific financial concepts. A 2023 YouTube trends report indicated that "how-to" videos related to personal finance saw a 70% increase in viewership in India.

Blogs and Podcasts: For those who love words and longer-form discussions.

- Blogs: Write detailed articles, guides, and personal stories. You can include charts, graphs, and links to resources. SEO is your friend here!

- Podcasts: Have conversations about money. Interview guests, discuss financial news, or do solo episodes sharing your insights. This format is great for busy people who can listen on the go. Think of a podcast titled "Paisa Vaisool" or "Chai and Chatter about Charms (money)."

Audience Demographics: Who Are You Talking To?

Understanding who you're trying to reach will help you tailor your content effectively. Financial content appeals to a wide range of people:

Young Professionals (22-35 years old):

- They're often starting their careers, earning their first regular paychecks (maybe around ₹30,000 - ₹1,00,000 per month).

- Interested in: Budgeting for city living, saving for big purchases (car, house), starting investments, managing student loans, understanding salary slips and taxes.

- They appreciate actionable tips and digital tools.

Students (18-22 years old):

- Learning about money for the first time.

- Interested in: Saving pocket money, part-time job income, budgeting for college expenses, scholarships, basics of banking, avoiding debt.

- Content needs to be super simple, engaging, and often visual. Think short, snappy videos or infographics.

Middle-Income Groups (30-50 years old):

- Often juggling family responsibilities, home loans, and planning for the future. Income might range from ₹60,000 to ₹2,50,000+ per month.

- Interested in: Long-term investments, retirement planning, insurance, children's education planning, managing household budgets.

- They value trustworthy, well-researched information.

Aspiring Investors:

- This group can span various ages and income levels but shares a common interest in growing their wealth.

- Interested in: Learning about different investment avenues (stocks, mutual funds, real estate, crypto), risk management, market analysis (basics).

- They seek clarity and guidance to navigate the complexities of investing.

Knowing these groups helps you create content that speaks directly to their needs and financial questions.

For example, content for students might focus on "How to Save ₹500 from your Pocket Money," while for young professionals, it might be "Best SIPs for Beginners under ₹5000."

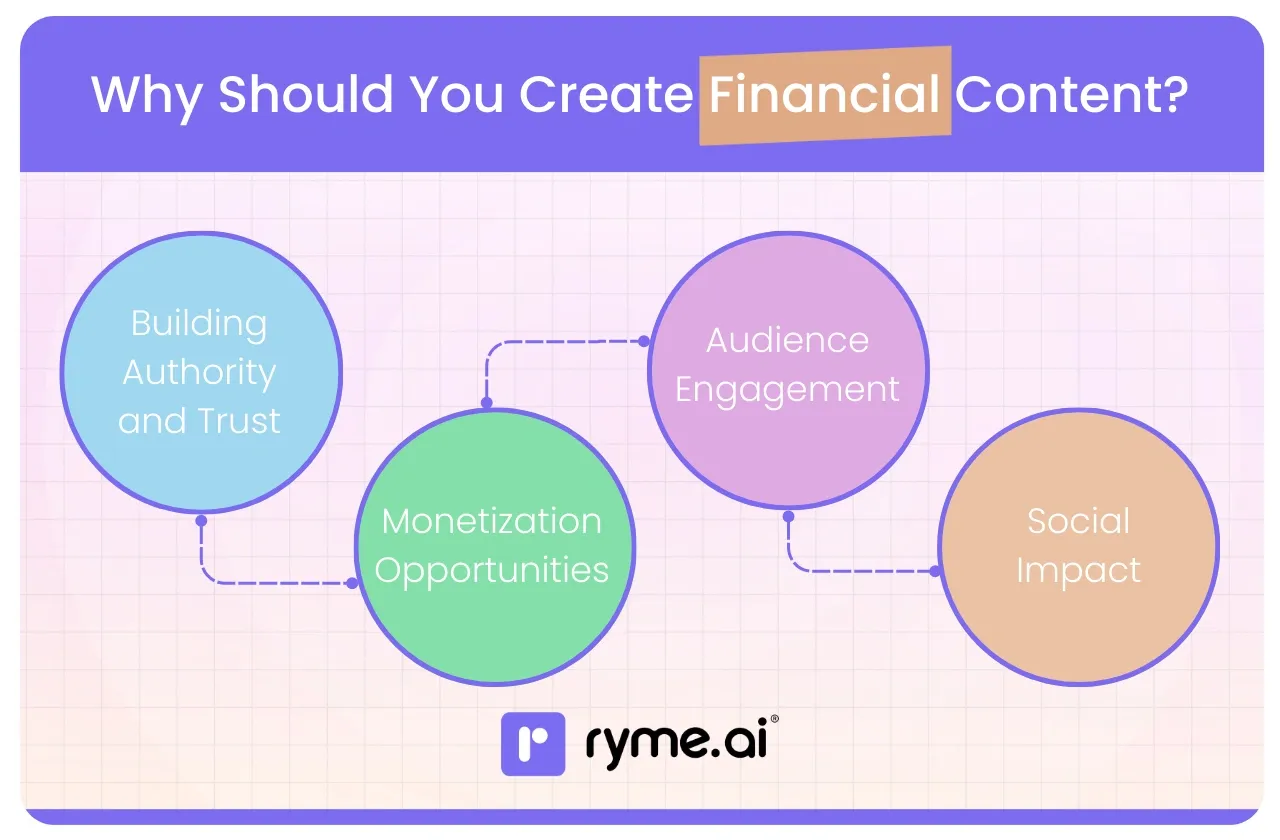

Why Should You, as an Influencer, Create Financial Content?

Okay, so you get what financial influence is all about. But maybe you're thinking, "Why should I jump into this? I talk about fashion/travel/lifestyle/tech..." Well, hear me out! Adding financial content to your repertoire, or even making it your main focus, has some seriously amazing benefits. It's not just about numbers; it's about impact, trust, and yes, even your own growth!

1) Building Authority and Trust: Become the Go-To Guru! 🤓

When you consistently provide valuable, accurate, and easy-to-understand financial insights, you position yourself as a credible and trustworthy source. People are actively looking for reliable information on money matters. If you're the one breaking down complex topics like "how to read your first stock chart" or "understanding inflation's effect on your ₹10,000 savings," your audience will start seeing you as an authority.

Think about it: When your followers need advice on a new budgeting app or want to understand a news headline about the economy, who will they think of? You! This trust is invaluable. It deepens your connection with your existing audience and attracts new followers who are specifically seeking financial guidance.

Real-world impact: Imagine someone messages you saying, "Thanks to your video on starting an SIP, I've finally started investing for my future!" That’s powerful.

Data Point: A 2023 Nielsen study found that 70% of consumers trust recommendations from influencers, but for financial advice, the bar for credibility is even higher. By focusing on accuracy and clarity, you build that essential trust.

2) Monetization Opportunities: Ka-Ching! 💸

Let's be real, influencing is also about earning a living. Financial content opens up a wealth of monetization avenues. The finance industry is huge, and brands are constantly looking for authentic voices to connect with their target audiences.

Brand Partnerships: Fintech companies (think payment apps, investment platforms, neo-banks), educational platforms offering finance courses, insurance providers, and investment services are all keen to collaborate with financial influencers. These partnerships can range from sponsored posts and videos to affiliate marketing deals. For example, a popular Indian investment app reported a 40% increase in user sign-ups attributed to their finfluencer campaigns in 2023.

Affiliate Marketing: You can recommend financial products or services you genuinely use and trust (e.g., a specific Demat account, a budgeting tool, or a financial literacy course) and earn a commission for every sign-up or sale made through your unique link.

Your Own Products/Services: As you build authority, you could create and sell your own digital products like budget templates (sellable for ₹99-₹499), e-books on investing basics, or even paid workshops and webinars.

Consulting: Some established finfluencers offer one-on-one coaching or consultation services (though be careful about regulations around financial advice).

The average earning per post for finance-focused micro-influencers (10k-50k followers) in India saw a jump of nearly 25% in 2023 compared to the previous year, indicating a growing market value.

3) Audience Engagement: Get Them Talking! 💬

Money is a topic that affects everyone, and people have strong opinions and lots of questions about it. This makes financial content inherently engaging.

- Spark Discussions: Posts about saving money, investment mistakes, or budgeting hacks often ignite lively comment sections. People love to share their own experiences, tips, and challenges.

- Q&A Power: Hosting Q&A sessions (live or through Instagram Stories) about financial topics can lead to massive engagement. "What's your biggest money worry right now?" or "Ask me anything about mutual funds!"

- Relatability: Sharing your own financial journey – your successes, your mistakes, your learnings – makes you incredibly relatable. When you talk about struggling to save or figuring out investments, your audience sees themselves in your story.

- Higher Shares: Useful financial tips, like "How to save ₹10,000 in 3 months," are highly shareable as people want to pass on valuable information to their friends and family. A 2024 social media trends report highlighted that "informational and educational carousels" on finance had one of the highest save and share rates on Instagram.

4) Social Impact: Make a Real Difference! 🌍💖

This is a big one. By educating your audience on financial literacy, you're not just creating content; you're empowering them. You're helping them make informed decisions, build financial security, and potentially change their lives for the better.

- Empowerment: Many people feel lost or intimidated by finance. Your content can demystify money, give them confidence, and help them take control of their financial future. You could be the reason someone starts an emergency fund that later saves them from a crisis, or the reason a student avoids a common financial pitfall.

- Closing the Gap: Financial literacy levels vary widely. You can play a crucial role in making financial education accessible to everyone, regardless of their background. Content in regional languages like Tamil or Marathi can have an even greater impact.

- Positive Change: Helping people manage debt, save for their goals, and invest wisely contributes to a more financially stable and resilient society. That’s a pretty awesome legacy to build, right?

According to a Reserve Bank of India (RBI) survey referenced in financial reports in late 2023, while financial literacy is improving, targeted digital initiatives are crucial for reaching younger demographics and those in Tier-2 and Tier-3 cities – a space where influencers can make a massive contribution.

So, if you're looking for a niche that's rewarding in terms of engagement, monetization, and making a positive impact, financial content creation is definitely worth considering. You have the platform, you have the voice – why not use it to help people (and yourself) grow financially?

How to Create Impactful Financial Content

Alright, you're convinced! You're ready to start sharing your financial wisdom. But how do you make sure your content actually hits the mark? How do you create financial content that’s not just informative, but also engaging, understandable, and genuinely helpful? Let’s get into the nitty-gritty.

1) Understanding Your Audience's Needs: Be a Financial Detective! 🕵️♀️

Before you create anything, you need to know who you're talking to and what they really want to learn. Don't just guess!

Conduct Polls and Surveys: Use Instagram Stories polls, Twitter polls, or Google Forms surveys. Ask direct questions:

- "What's your biggest money challenge right now?" (Options: Saving, Investing, Budgeting, Debt)

- "Which financial topic confuses you the most?"

- "What do you want to learn about next: Stocks, Mutual Funds, or Crypto?"

- "Are you more interested in saving ₹5,000 a month or investing ₹1,000 a month?"

Engage in Comments: Your comments section is a goldmine. Pay attention to the questions people ask on your existing posts (even if they're not finance-related yet). What are they curious about? What problems are they mentioning?

If someone comments, "I wish I knew how to save more," that's a clear signal!

Host Q&A Sessions: Announce a Q&A on "All Things Money" and see what questions pour in. This will give you a direct pipeline into their financial pain points.

Analyze Your DMs: People might be more comfortable asking sensitive money questions privately. Note recurring themes.

Create a Persona: Based on your research, create a simple audience persona. For example: "Meet Riya, 25, a young professional in Bangalore earning ₹60,000/month. She wants to start investing but finds it overwhelming. She uses Instagram daily and prefers short, visual content." This helps you stay focused.

Once you understand their needs, you can create content that feels like it was made just for them. This targeted approach leads to much higher engagement and impact.

2) Simplifying Complex Concepts: Make Finance Fun! (Yes, Really!) 🎉

Finance can be full of jargon and complicated ideas. Your job is to be the translator, the simplifier, the one who makes it all click.

Break It Down: Don't try to explain the entire stock market in one 60-second Reel. Focus on one small concept at a time.

- Instead of "A Guide to All Investment Types," try "What is an SIP? Explained in 30 Seconds!"

- Use Analogies and Storytelling: Relate complex ideas to everyday things.

- "Think of compound interest like a snowball rolling downhill. It starts small, but the more it rolls (the longer you invest), the bigger it gets, picking up more snow (returns) along the way!"

- Share stories (your own or anonymized examples) to illustrate points. "Let me tell you how Sarah saved for her first international trip by cutting just three small expenses..."

Visuals are Your Best Friend:

Reels and Short Videos: Use on-screen text, quick cuts, and engaging visuals. Animate charts, use trending audio (if appropriate), and keep it concise.

Mind Maps or Flowcharts: For slightly more complex processes like "Open PPF Account."

Avoid Jargon (or Explain It Immediately): If you must use a technical term, explain it in the simplest way possible, right away. Imagine you're explaining it to a 10-year-old.

"Explain Like I'm 5" (ELI5) Series: This can be a very popular content format.

Remember, clarity trumps complexity. Your audience will love you for making finance feel less scary and more accessible.

3) Consistency is Key: Be the Reliable Resource 🗓️

Imagine your favourite TV show only aired new episodes randomly. You'd lose interest, right? The same goes for your content. Regular posting keeps your audience engaged and signals that you're a dependable source of information.

Create a Content Calendar: Plan your content in advance. Decide what topics you'll cover, what format you'll use (Reel, carousel, blog post), and when you'll post it. This saves you from last-minute scrambling.

Example Weekly Plan:

- Monday: #MoneySavingMonday Tip (Quick Reel)

- Wednesday: #WealthWisdomWednesday Deep Dive (Carousel or Blog Snippet)

- Friday: #FinancialFreedomFriday Q&A (Instagram Story or Live)

Batch Create Content: Dedicate a few hours or a day to create multiple pieces of content at once. This is much more efficient.

Quality over Quantity (but aim for regular quantity!): Don't sacrifice the quality of your information just to post daily. But aim for a consistent schedule that works for you – whether it's 3 times a week or 5 times a week.

Stay Top-of-Mind: Regular content ensures you appear in your audience's feeds more often. The more they see your valuable content, the more they'll trust you and think of you for financial insights. A 2023 report on social media algorithms suggested that consistent posting, especially of video content, significantly boosts visibility.

4) Collaborating with Experts: Two Heads are Better Than One! 🤝

You don't have to know everything! Collaborating with other experts can add immense credibility and value to your content.

Invite Guest Speakers: Host Instagram Live sessions or YouTube interviews with:

- Chartered Accountants (CAs) to discuss tax basics.

- SEBI-registered investment advisors (RIAs) for general market insights (ensure they stick to general advice, not personalized recommendations for your audience).

- Experienced investors or financial planners.

Co-create Content: Partner with another influencer (maybe someone in a related niche like career coaching or sustainable living) for a joint post or video on a topic like "Financial Planning for Freelancers" or "Ethical Investing."

Quote Reputable Sources: When sharing data or specific information, always cite credible sources like RBI reports, SEBI guidelines, or well-known financial publications. This shows you've done your research.

Benefits:

- Adds Credibility: Featuring experts lends more authority to your platform.

- Fresh Perspectives: Guests bring new insights and viewpoints.

- Cross-Promotion: You both get exposure to each other's audiences.

Just ensure your collaborators are genuinely knowledgeable and align with your values of providing clear, unbiased information.

5) Staying Updated: Keep Your Finger on the Financial Pulse 📈📰

The financial world is always changing. New regulations, market trends, economic news – you need to stay current to provide timely and relevant content.

Follow Reputable Financial News Sources: Read financial newspapers (Economic Times, Mint, Business Standard), follow financial news websites, and subscribe to newsletters from credible institutions.

Track Market Trends: Keep an eye on what's happening in the stock market, interest rates, inflation, etc. You don't need to be a day trader, but have a general awareness.

Understand New Regulations: Changes in tax laws, investment rules (e.g., new SEBI guidelines for influencers), or banking policies can directly impact your audience. Be among the first to explain these changes simply.

Attend Webinars and Courses: Invest in your own learning. Many organizations offer free or paid webinars on financial topics.

Listen to Your Audience: If they start asking about a new financial product or a recent economic event, that's your cue to research and create content on it.

By staying updated, you ensure your content is always fresh, relevant, and accurate, further solidifying your position as a trusted financial guide. Imagine a major budget announcement happens – if you can quickly post a Reel explaining the key takeaways for the common person in simple terms (e.g., "Budget 2025: What it means for YOUR wallet! 👛"), your audience will find it incredibly valuable.

Creating impactful financial content is a blend of understanding your audience, simplifying the complex, being consistent, collaborating wisely, and always learning. It takes effort, but the rewards – a highly engaged community, a trusted reputation, and the satisfaction of genuinely helping people – are well worth it!

Leveraging ryme.ai for Financial Content Creators

So, you're creating amazing financial content, building your audience, and making an impact. That’s fantastic! But what if you could streamline your brand collaborations, get paid faster, and access opportunities specifically tailored to your niche and even your regional language skills? This is where a platform like ryme.ai comes into play, acting like your super-smart assistant for influencer marketing. 🚀

ryme.ai is an AI-powered influencer marketing platform. Its main goal is to connect talented creators like you with awesome brands. But it's more than just a matchmaker. It offers a suite of tools to help you manage your campaigns, see how well your content is doing, and get your hard-earned money without any fuss.

Think of it as your personal gateway to better, more consistent brand deals, especially if you're a financial influencer. Why? Because as financial content gains more traction, brands are specifically looking for creators who can speak authentically about money.

Benefits for Financial Influencers: Why ryme.ai is Your Friend

Let's look at how ryme.ai can specifically help you as a financial content creator:

1) Consistent Brand Collaborations: More Deals, Less Hassle! 🤝✨

Finding good, regular brand deals can be time-consuming. You're busy creating content, and chasing brands isn't always the best use of your creative energy.

Recurring Deals: ryme.ai focuses on helping you engage in recurring deals with financial brands. This means instead of one-off campaigns, you could build longer-term relationships with fintech companies, banks, or investment platforms that value your financial expertise. Imagine having a steady stream of collaborations lined up!

Targeted Matches: The AI helps match you with brands that are a perfect fit for your content style, audience demographics, and financial niche. So, if you talk about mutual funds for beginners, you're more likely to get matched with a mutual fund platform.

2) Instant Payments: Get Paid on Time, Every Time! 💸💨

One of the biggest headaches for influencers can be payment delays. You've done the work, the campaign is live, but then you wait... and wait... for your payment.

No More Chasing: ryme.ai aims to solve this with its instant payment feature. This means once your content is approved and the campaign milestones are met, you receive your payments promptly through the platform.

Peace of Mind: Timely payments mean better cash flow for you, allowing you to focus on what you do best – creating quality content. No more awkward follow-up emails about invoices! This is a huge stress reliever. For example, a recent industry survey (though not ryme.ai specific, it highlights the problem) showed that nearly 45% of Indian influencers experienced payment delays of over 30 days in 2023. Platforms addressing this are a game-changer.

3) Performance Analytics: Know What Works and Grow! 📊📈

To keep improving, you need to understand how your content is performing, especially for sponsored campaigns.

Detailed Insights: ryme.ai provides access to detailed analytics for your campaigns. You can see engagement rates, reach, impressions, and other key metrics directly on the platform.

Refine Your Strategy: These insights help you understand what kind of financial content resonates most with your audience during brand collaborations. For example, you might discover that your Reels explaining complex terms get higher engagement than static posts for a particular fintech brand. This data empowers you to refine your content strategy and deliver even better results for future campaigns (and for your organic content too!).

4) Localized Opportunities: Connect with Your Regional Audience! 🇮🇳🗣️

India is a land of diverse languages. Financial literacy needs to be accessible to everyone, not just English speakers.

Regional Language Support: ryme.ai actively connects creators with brands targeting regional audiences. So, if you create amazing financial content in languages like Tamil, Marathi, Hindi, Bengali, Telugu, Kannada, or others, this platform can open up a whole new set of opportunities.

Deeper Connection: Brands understand that communicating in a local language builds a stronger connection and trust, especially when it comes to sensitive topics like finance. If you're a creator fluent in a regional language, your skills are highly valuable. Imagine explaining SIPs in Tamil to an audience in Chennai – the impact is huge! This is a significant advantage that ryme.ai emphasizes.

How to Get Started with ryme.ai: Your Quick Guide 📝

Ready to explore what ryme.ai has to offer? Getting started is usually straightforward:

- Sign Up: Head over to the ryme.ai website (you'll need to search for their official site) and create your influencer account.

- Complete Your Profile: This is crucial! Fill out your profile with as much detail as possible.

- Niche-Specific Info: Clearly state that you're a financial influencer. Mention your specific areas of expertise (e.g., personal budgeting, stock market basics, crypto education).

- Audience Demographics: Provide insights into your audience (age, location, interests).

- Language Fluency: Highlight any regional languages you create content in.

- Portfolio: Link to your social media profiles and perhaps showcase some of your best-performing financial content.

- Browse and Apply for Campaigns: Once your profile is set up, you can explore available campaigns. Look for those that align with your financial niche and values. The platform's AI might also suggest relevant campaigns to you.

- Create and Submit Content: If you're selected for a campaign, you'll receive a brief from the brand. Create your awesome financial content according to the guidelines and submit it through the ryme.ai platform.

- Track Performance and Receive Payments Seamlessly: After your content goes live, you can monitor its performance using the analytics tools. And, most importantly, receive your payments quickly and easily through the platform.

Platforms like ryme.ai are designed to empower creators by simplifying the business side of influencing.

For financial influencers, this means more time to focus on educating your audience and less time bogged down in administrative tasks. It’s about making the collaboration process smoother, faster, and more rewarding. Definitely worth checking out if you're serious about growing your financial influencing journey!

Top Financial Influencers to Follow in 2025

Looking for some inspiration? Want to see who's already making waves in the financial content space? Following established and emerging finfluencers can give you great ideas for content, style, and engagement. Here’s a mix of global and Indian financial influencers who are doing an amazing job educating and empowering their audiences. (Remember, this landscape is always evolving, so keep an eye out for new talent too!)

Global Finfluencers: Learning from the World's Best 🌍

These influencers have a massive reach and cover a wide array of financial topics, often with a global perspective.

- Graham Stephan: Known for his frugality, real estate insights, and detailed YouTube videos on investing and personal finance. He breaks down complex topics with a no-nonsense, data-driven approach.

- Robert Kiyosaki: Author of "Rich Dad Poor Dad," he focuses on financial education, entrepreneurship, and different perspectives on wealth building, often challenging conventional wisdom.

- Dave Ramsey: Famous for his "Baby Steps" approach to getting out of debt and building wealth. His radio show and books have guided millions towards financial peace.

- Humphrey Yang: Creates engaging short-form videos (TikTok, YouTube Shorts, Instagram Reels) that simplify personal finance, investing, and economic concepts for a younger audience. Very good at making finance feel less intimidating.

- Chris Gledhill: A leading voice in FinTech and the future of finance. He shares insights on banking innovation, digital currencies, and how technology is transforming money. Great for understanding broader industry trends.

- Jim Marous: Co-publisher of The Financial Brand and host of the "Banking Transformed" podcast. He focuses on digital banking, customer experience, and financial marketing. Highly relevant for understanding the business side of finance.

- Brett King: Futurist, author, and speaker known for his work on the future of banking ("Bank 2.0, 3.0, 4.0"). He explores how technology is disrupting the financial services industry.

- Theodora Lau: Founder of Unconventional Ventures, she champions financial inclusion, longevity, and agetech. Her work often highlights how finance can better serve underserved communities and an aging population.

- Spiros Margaris: Venture capitalist and futurist focusing on FinTech and InsurTech. He provides high-level insights into innovation and the strategic deployment of AI in financial services.

- Joshua Brown (The Reformed Broker): CEO of Ritholtz Wealth Management. His blog and social media presence offer witty, insightful commentary on markets, investing, and financial news. He cuts through the noise with a dose of reality.

Indian Finfluencers: Voices Closer to Home 🇮🇳

These Indian finfluencers create content tailored to the Indian context, covering everything from local investment options to financial planning nuances specific to India. They are making a huge impact in promoting financial literacy across the country.

- Rachana Ranade: A Chartered Accountant who simplifies stock market concepts, mutual funds, and personal finance through her popular YouTube channel and courses. Her teaching style is very clear and methodical.

- Ankur Warikoo: Entrepreneur and content creator who shares insights on personal growth, entrepreneurship, and finance. His financial advice often focuses on mindset, habits, and long-term thinking.

- Pranjal Kamra: Co-founder of Finology. He creates YouTube videos and content focused on value investing, stock analysis, and financial planning, aiming to make financial education accessible.

- Sharan Hegde (Finance with Sharan): Known for his engaging and often humorous Instagram Reels that break down personal finance, investing, and career advice for young Indians.

- Neha Nagar (Tax Scounting): A CA who simplifies taxation, personal finance, and investment topics. She makes complex tax-related information easy to grasp.

- Varun Malhotra (EIFS): Focuses on investor education, particularly on mutual funds and financial planning. He emphasizes disciplined investing for long-term wealth creation.

- Akshat Shrivastava: Known for his direct and often data-backed opinions on investing, personal finance, and economic trends. He encourages critical thinking among his audience.

- Anushka Rathod: Creates content on stock markets, personal finance, and financial independence, often sharing her own investment journey and learnings.

- Asset Yogi (Mukul Malik): Provides comprehensive videos on personal finance, real estate, mutual funds, stocks, and insurance in Hindi, making it accessible to a wider audience.

- Radhika Gupta: MD & CEO of Edelweiss Mutual Fund. While a CEO, her social media presence and talks often simplify investing concepts and encourage financial participation, especially for women.

Emerging Creators: The Rising Stars 🌟

The world of financial influencers is constantly growing! While the names above are well-established, new creators are bringing fresh perspectives and innovative content formats every day.

Who to look for?

- Creators focusing on hyper-niche topics (e.g., sustainable investing in India, finance for gig economy workers, demystifying agricultural finance).

- Influencers creating content in regional languages with high engagement. A 2024 insight from a regional content marketing agency noted that finfluencers in Tamil, Telugu, and Marathi are seeing rapid audience growth.

- Those who are exceptionally good at using new platform features (like Instagram's latest interactive tools or new short-form video trends) for financial education.

- Creators who champion financial inclusion for specific demographics (e.g., women in Tier-2 cities, individuals with disabilities).

How to find them?

- Keep an eye on hashtags like #FinancialLiteracyIndia #IndianFinancetips #[YourRegionalLanguage]Finance (e.g., #TamilFinance).

- See who established influencers are collaborating with or giving shoutouts to.

- Look for creators featured on platforms like ryme.ai that promote diverse talent.

Your Actionable Tip: Spend some time each week exploring content from these influencers. Don't just passively watch; analyze!

What topics are they covering?

- What content formats are they using (Reels, carousels, long videos, podcasts)?

- How do they engage with their audience in the comments?

- What makes their content unique or relatable?

This isn't about copying them, but about learning from their successes and finding your own unique voice and style within the financial content creation space. Every single one of these creators started somewhere, often with a small audience, but their passion for sharing financial knowledge helped them grow. You can do it too!

Tips for Aspiring Financial Influencers: Your Journey to Making an Impact

Feeling inspired and ready to jump in, or maybe scale up your existing financial content? That's awesome! Becoming a trusted financial influencer is a marathon, not a sprint. It’s about building genuine connections and providing real value. Here are some friendly tips to guide you on your journey. Think of this as advice from a mentor who’s cheering you on! 📣

1) Start with Personal Experiences: Your Story is Your Superpower! 💪

You don't need to be a seasoned financial wizard from day one. Your personal journey with money – your struggles, your wins, your "aha!" moments – is incredibly relatable and can be the foundation of your content.

Share your journey: Did you struggle to create your first budget? Talk about it! How did you save for your first big purchase (a bike, a laptop, a trip)? Share the steps. Did you make an investment mistake? Sharing what you learned can be more valuable than pretending you know everything.

Example: "Hey everyone! I remember when I got my first paycheck of ₹25,000. I was so excited... and then so confused about what to do with it! 😅 Here’s what I learned about budgeting that might help you too..."

Builds Relatability: When you're open and honest, your audience connects with you on a human level. They see you're not just preaching from on high, but you've walked the path yourself. This builds trust faster than anything else.

You don't need to be rich to talk about money: Your experiences managing a tight budget or saving a small amount consistently are just as valid and helpful as someone discussing large investment portfolios.

2) Educate, Don't Just Advise: Teach Them to Fish! 🎣

There's a difference between telling someone what to do and teaching them how to think. Aim to empower your audience with knowledge so they can make their own informed decisions.

Focus on Concepts: Instead of saying "Buy this stock now!" (which can be risky and is often regulated), explain how to analyze a stock, or what factors to consider before investing.

Explain the "Why": Don't just give a budgeting tip; explain why it works. For example, instead of "Save 10% of your income," explain the concept of "paying yourself first" and its long-term benefits.

Provide Frameworks: Offer tools, frameworks, or mental models they can use. For instance, explain the 50/30/20 budgeting rule (50% needs, 30% wants, 20% savings) and how they can adapt it.

Your Goal: To help your audience become financially literate, not financially dependent on your "hot tips."

This approach is more sustainable and ethical. A 2023 study on consumer trust in financial advice highlighted that users appreciate influencers who explain underlying principles rather than just giving direct buy/sell calls.

3) Engage with Your Audience: It's a Two-Way Street! 🗣️💬

Your audience is your community. Nurture it! Engagement isn't just about likes and views; it's about building relationships.

Respond to Comments: Make an effort to reply to comments and DMs (as much as feasible). Even a simple acknowledgment can make someone feel heard.

Conduct Q&A Sessions: Regularly host "Ask Me Anything" sessions on Instagram Stories, YouTube Live, or Twitter Spaces. This is a fantastic way to address their specific questions directly.

Create Content Based on Audience Queries: If many people are asking about a particular topic (e.g., "How do I choose my first credit card?"), create a detailed post or video about it. This shows you're listening.

Build a Community: Encourage discussions. Ask questions in your captions. Create a Facebook group or Discord server for your most engaged followers.

Story Example: "Riya, a budding finfluencer, noticed many comments asking about navigating financial discussions with family. She created a sensitive and helpful video on 'Talking Money with Your Parents,' which resonated deeply and sparked a huge, positive conversation, growing her followers by 10k in just 3 months because it hit a real nerve."

4) Maintain Transparency: Honesty is the Best Policy (Especially with Money!) ✅

Trust is the cornerstone of being a financial influencer. And transparency is key to building and maintaining that trust.

Disclose Affiliations: If you're promoting a product or service and will get paid for it (e.g., affiliate links, sponsored posts), clearly disclose this. Use #ad, #sponsored, or a clear verbal/written disclaimer. SEBI has also issued guidelines for financial influencers regarding disclosures, so make sure you're aware of and comply with them.

Be Clear About Your Qualifications (or Lack Thereof): If you're not a registered financial advisor (and most influencers aren't), make that clear. State that your content is for educational and informational purposes only and not financial advice. Encourage your audience to consult with qualified professionals for personalized advice.

Share Both Pros and Cons: When reviewing a financial product, don't just highlight the good stuff. A balanced review that includes potential drawbacks makes you more credible.

Avoid Exaggerated Claims: Be wary of promising guaranteed high returns or "get rich quick" schemes. Finance involves risk, and it's important to be realistic.

5) Stay Authentic: Be Yourself, Everyone Else is Taken! 😉

There are many financial influencers out there. What will make you stand out? Your unique voice, personality, and genuine passion.

Find Your Style: Are you super analytical and data-driven? Or are you more of a storyteller who uses humor? Embrace your natural style. Don't try to be a copy of someone else.

Share Your Values: What's important to you about money? Financial independence? Ethical investing? Helping others avoid debt? Let your values shine through your content.

Be Consistent in Your Voice: Whether it's witty, serious, or super friendly, maintain a consistent tone across your platforms. This helps your audience get to know the "real" you.

Don't Be Afraid to Be Vulnerable (Appropriately): As mentioned in Tip #1, sharing your own experiences, even the mistakes, makes you authentic and relatable.

A Loyal Community: When you're genuine, you attract an audience that resonates with you, not just the topic. This leads to a more loyal and engaged community.

Becoming a financial influencer is an exciting and rewarding path. It takes dedication, a willingness to learn, and a genuine desire to help others. By following these tips, you'll be well on your way to creating impactful content and building a thriving community. You got this! 🎉

Conclusion: Your Time to Shine in the Financial Space!

Financial influencing is a great opportunity for creators to simplify complex money topics, connect with brands via platforms like ryme.ai, and get paid. People seek clear, relatable financial guidance, and your unique perspective can empower many through various platforms.

The demand for financial literacy is growing, especially in India, where young professionals, students, and families need help managing their finances. Don't be intimidated; share your experiences, learn continuously, and be authentic. As a financial influencer, you build trust, foster community, and make a real difference. Start sharing your financial wisdom; the world needs your voice!